Helping You Navigate The FCA's Consumer Duty

The FCA’s Consumer Duty is its response to their ongoing concerns about how are consumers are treated and moves the dial away from how customers are treated (fairly?) to the experience they have received. With the latter the FCA’s expectation is that firms will focus on customer outcomes and how best to achieve a positive one. In focusing on outcomes firms will be expected to consider the differing needs of their customers and will have to tailor the customer journey accordingly.

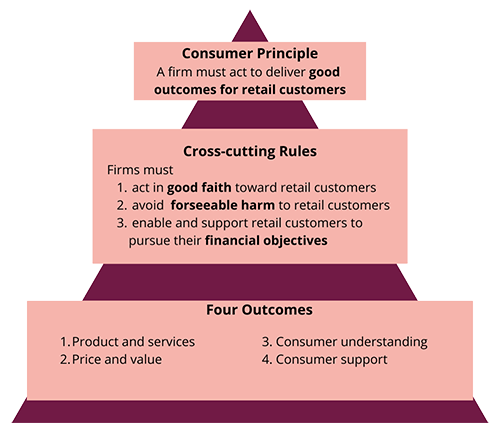

The Consumer Principle – a new Principle 12 ‘Consumer Duty’

A new consumer Principle which will require that “a firm must act to deliver good outcomes for retail customers”. This will require firms to consider the reasonable expectations of their customer base as a whole, rather than achieving the absolute best outcome for each and every customer.

Cross-cutting Rules

New rules and guidance (including a significant Handbook chapter at PRIN 2A) which provide the structure to drive the key behaviours required by the Consumer Duty and make clear that the Consumer Principle requires firms to:

- act in good faith

- take all reasonable steps to avoid foreseeable harm to consumers

- take all reasonable steps to enable consumers to pursue their financial objectives

The Four Required Outcomes

These Consumer Duty outcomes are to be driven by the new rules in PRIN 2A. In summary, they are:

- Products and Services: all products and services for retail customers to be fit for purpose, designed to meet consumers’ needs, and targeted at those consumers. There is significant crossover between the proposed rules and guidance in this section and the existing Product Oversight and Governance rules.

- Price and Value: consumers to receive fair value. This outcome is very much in line with the FCA’s insurance pricing ‘fair value’ requirement.

- Consumer understanding: firms’ communications must support and enable consumers to make informed decisions about financial products and services; consumers must be given the information they need, at the right time, and presented in a way they can understand. Similar requirements are already in place in ICOBS.

- Customer Support: firms must provide a level of support that meets consumers’ needs throughout their relationship with the firm.

There is a significant amount of work to be undertaken by firms to plan and initiate any changes required to the customer journey, documentation and management information, in addition to existing deadlines for product governance documentation and reporting. Any firm wishing more assistance with the Consumer Duty should contact us asap. We can support firms by undertaking an audit or gap analysis of existing processes and assist in the preparation of the implementation plan, due by 31st October 2022 as can be seen by the outline below.

If you have any questions about consumer duty or or would like to talk to us about any of the information above, please get in get in touch today and have a conversation with one of our FCA Compliance Consultants.

Get in Touch More about Consumer Duty Guidance

Your Next Consumer Duty Board Report is Due July 31st - Are You Ready?

The Consumer Duty Board Report is effectively an annual review of how a firm has approached the implementation of the Consumer Duty. From a governance perspective it must be seen, discussed and agreed by a firm’s Board even though it can be prepared by other parts of the business. Production of the Consumer Duty Board Report is an annual requirement with the next one being completed by 31st July 2025.

For further information, check out our detailed page on the Consumer Duty Board Report.

You can even request our FREE Consumer Duty Board Report template!